Citizenship by Investment (C.B.I.) and Residency by Investment (R.B.I.) programs represent legal legislative frameworks operating in certain countries that allow individuals to expedite residency or citizenship in exchange for specified financial investments in the local economy.

Generally speaking, these programs offer, in return for investment, immediate citizenship (the so-called “golden passport,” also known as “cash-for-passports”) or a hybrid model encompassing immediate residency followed by accelerated citizenship.

Though these programs are entirely legal and constitute important revenue sources for many states—particularly small island economies—their unique characteristics make them especially vulnerable to money laundering, sanctions evasion, and other financial crimes. The Financial Action Task Force, the Organisation for Economic Co-operation and Development, the European Union, and the United States intensively monitor these programs and are imposing increasingly rigorous compliance requirements.

The Scale of the Market

In November, 2023, the E.U. disclosed that five Caribbean nations had sold eighty-eight thousand “golden passports.” The European Commission expressed concerns about the security of the golden-passport trade and promised tightened visa controls. The published report presented, for the first time, the true scale of the Caribbean passport trade. Many countries sell citizenship to foreigners, with prices starting at a hundred thousand dollars (eighty-two thousand three hundred and twenty-six pounds) per person.

For small island nations, C.B.I. revenues can constitute thirty to fifty per cent of government income, creating powerful economic incentives that must be balanced against risks to system integrity.

The Vulnerabilities

Identity Laundering and Alternative Profiles

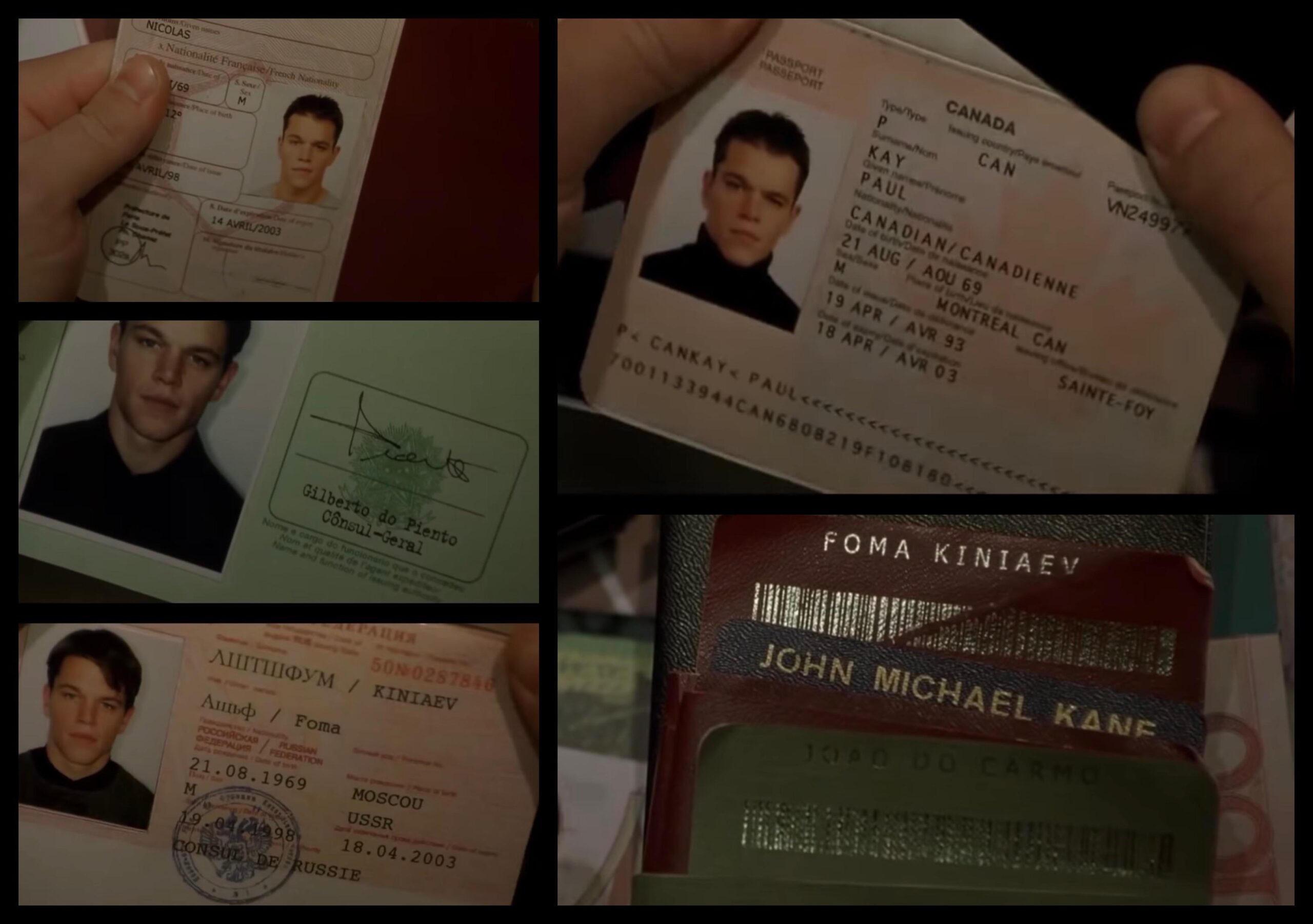

C.B.I. programs present a particular vulnerability because they enable illicit actors to gain significantly enhanced global mobility and the capacity to establish new legal identities. The relatively swift conferral of citizenship and the associated passport make these programs—though themselves legal—susceptible to exploitation by criminals seeking new, clean identities.

Financial institutions rely heavily on documentary evidence of a person’s connection to a jurisdiction. C.B.I. programs, by providing legitimate identity documentation, can be abused to mask the true nature of an individual’s activities. This “identity laundering” operates by building profiles around legal substance rather than physical migration, creating competing profiles in alternative jurisdictions.

Facilitating Illicit Fund Flows

C.B.I. and R.B.I. programs—though designed as legitimate tools for attracting foreign investment—can be abused by criminally wealthy individuals to place assets and family members abroad to frustrate asset recovery, explain suspicious high-value transactions, and enable the cross-border flow of significant illicit funds.

The programs facilitate the final stage of laundering by embedding criminal proceeds in legitimate foreign ventures, such as real estate or business investments, providing both legitimate identity and credible explanations for wealth sources.

Shell-Company Exploitation

Offshore shell companies—themselves legitimate corporate structures—when combined with C.B.I. passports can be abused to create complex ownership structures that conceal the actual beneficiary. By combining new citizenship with shell companies registered in various jurisdictions, multiple layers of legal separation can be created between the beneficiary and the source of funds.

International-Sanctions Evasion

In November, 2023, it emerged that Chinese criminals were using passports from Cambodia, Cyprus, and even the tiny island of Vanuatu to cross borders, avoid prison, and launder billions of dollars siphoned from telephone scams, online gambling, and Ponzi schemes throughout Asia. The “citizenship for sale” phenomenon came under renewed scrutiny following Singapore’s seizure, on August 15, 2023, of assets worth 1.3 billion dollars in connection with a massive money-laundering investigation.

That same month, Spain’s largest soccer league, La Liga, was found to have accepted payment from the Iranian telecommunications company M.T.N. Irancell through a Hong Kong-based shell company owned by an Iranian intermediary holding a Dominican Republic passport. The passport was used to establish a cover company that directed Iranian payments to La Liga, circumventing sanctions.

Systemic Weaknesses in Due Diligence

Insufficient Source-of-Funds Verification

Although applicants must regularly prove the legitimate origin of their investment funds, due-diligence procedures conducted by responsible authorities are often inadequate. These checks are also regularly outsourced to external agencies, opening further opportunities for influence. The vulnerabilities of these complex international investment-migration programs include frequent reliance on intermediaries, involvement of multiple government agencies, abuse by professional facilitators, and inadequate oversight of C.B.I./R.B.I. programs.

Professional Facilitators and Intermediaries

The heightened risk of money laundering and financial crime in investment-migration programs concerns not only applicants but also professional facilitators and intermediaries involved in the process. Professional facilitators—including lawyers, accountants, bankers, real-estate agents, and trust and corporate-service providers—play crucial roles that can be abused to facilitate illicit financial flows.

These intermediaries are not merely passive facilitators but are often active, and sometimes aggressive, providers of these services. A range of individuals, including lawyers, business directors, and accountants, must participate in completing complex C.B.I. transactions. Conduct may be intentional, reckless, improper, dishonest, or negligent through failure to fulfill their professional and regulatory obligations.

Politically Exposed Persons

One of the principal challenges in citizenship-by-investment due diligence is identifying politically exposed persons (P.E.P.s) and individuals with questionable backgrounds. P.E.P.s, owing to their position or connections, may present heightened risks of corruption, money laundering, or other illicit activities. The Fifth A.M.L. Directive expanded the scope of P.E.P.s to include virtual-asset service providers and citizenship-by-investment applicants.

Major Scandals and Cases

Cyprus: The Fall of the Golden Passport

The meteoric rise and sudden collapse of the Cyprus Investment Programme illustrates how legitimate investment programs can be abused. In its early years, the program attracted six billion euros in real-estate development when the country’s nominal G.D.P. was only twenty-four to twenty-five billion euros annually. In 2020, a journalistic investigation revealed confidential government documents showing how foreign politically exposed persons and their families received citizenship without proper due diligence.

An Al Jazeera investigation exposed how the program was being abused by criminals and politically exposed persons to acquire E.U. citizenship, with intermediaries and government officials willing to bend or break rules to facilitate citizenship sales to individuals with questionable backgrounds.

A government investigation found that more than half the passports issued under the program between 2013 and 2019 were illegal. A judicial inquiry conducted by former Supreme Court Justice Myron Nicolatos confirmed that fifty-three per cent of the 6,779 citizenships granted between 2007 and August, 2020, failed to meet legal requirements. Cyprus has since revoked citizenship from three hundred and sixty individuals (a hundred and one investors and two hundred and fifty-nine family members) as of September, 2025.

Malta: The Commodification of E.U. Citizenship

Leaked documents from Henley & Partners showed that wealthy non-E.U. citizens were receiving Maltese citizenship after spending merely days in the E.U. state, with some investors spending an average of only sixteen days in Malta during the one-year residency period before receiving citizenship. Investors could rent a yacht or make a charitable donation to prove a “genuine link” to the country.

In April, 2025, the European Court of Justice issued a landmark ruling declaring that Malta’s investor-citizenship program violated E.U. law, finding that granting nationality in exchange for predetermined financial contributions constituted “commodification” of citizenship. The Court emphasized that the program lacked provisions for establishing genuine links between applicants and Malta.

Dominica and the Caribbean: A Sanctions-Evasion Hub

An international investigation by the Government Accountability Project, the Organized Crime and Corruption Reporting Project, and media partners uncovered more than a hundred high-profile entities linked to passports obtained through Dominica’s C.B.I. program, including money launderers connected to Iran’s Revolutionary Guard, dozens of fugitive criminals, Russian oligarchs, “blood gold” smugglers, and high-ranking politicians from across the Middle East.

The investigation revealed that Dominica’s passport allows individuals sought by national law-enforcement agencies to travel freely, assisting sanctions evaders, money launderers, and persons investigated for extensive financial irregularities. Several Russian tycoons—including God Nisanov, Zarakh Iliyev, Omar Murtuzaliyev, Aleksandr Abramov, Vasiliy Anisimov, and others—obtained Dominican citizenship to evade Western sanctions imposed owing to their Kremlin connections and Russia’s ongoing invasion of Ukraine.

In response to mounting evidence of abuse, Dominica revoked sixty-eight C.B.I. citizenships obtained through fraud, false declarations, or concealment of material facts. Great Britain withdrew visa-free access for Dominican and Vanuatu citizens, citing “clear and obvious program abuses, including granting citizenship to individuals known to pose threats to Great Britain.”

Turkey: An Organized Criminal Network

In November, 2025, Turkish authorities dismantled an organized criminal network that facilitated fraudulent real-estate transactions for four hundred and fifty-one foreigners seeking citizenship by investment. The operation resulted in a hundred and six arrests across nineteen provinces and the seizure of assets worth millions of dollars, including twelve hundred and forty apartments, forty-seven cars, sixty-five plots of land, and numerous corporate entities.

The criminal organization arranged fictitious real-estate sales that allowed foreigners and their families to obtain Turkish citizenship, circumventing legitimate investment requirements. The scheme exploited loopholes in Turkey’s previous valuation system, where clients paid the required investment threshold of two hundred and fifty thousand dollars but received approximately eighty thousand dollars in cash refunds at notary offices. Police initiated citizenship-revocation procedures for all four hundred and fifty-one individuals who participated in the fraudulent transactions.

The Abramovich Case

In November, 2023, Portugal announced plans to abolish the Sephardic Jewish citizenship law. One high-profile case involved Roman Abramovich, the Russian-Jewish billionaire whose Portuguese naturalization met with criticism in light of geopolitical events—particularly Russia’s invasion of Ukraine—when it emerged that his European citizenship might potentially help him evade European sanctions imposed on Russian oligarchs.

In light of the controversy, the verification process was tightened. Foreign Minister Augusto Santos Silva noted that Sephardic-origin candidates had to establish a “genuine connection” to Portugal.

Common Reporting Standard Evasion

The O.E.C.D. published results of an analysis of more than a hundred R.B.I. and C.B.I. programs offered by jurisdictions engaged in C.R.S., identifying programs that potentially pose high risks to the integrity of the Common Reporting Standard. C.B.I./R.B.I. programs are offered by a significant number of jurisdictions enabling individuals to obtain citizenship or residency rights based on local investments or for a flat fee, and these programs can be abused to conceal offshore assets by avoiding C.R.S. reporting.

The problem lies in financial institutions’ reliance on self-certification of tax residence, and C.B.I./R.B.I. programs enable wealthy individuals to obtain new tax-residence documentation that can be used to declare themselves tax residents in low-tax jurisdictions while maintaining actual residence and economic ties elsewhere.

The International Regulatory Response

F.A.T.F. and O.E.C.D. Frameworks

In November, 2023, F.A.T.F. and the O.E.C.D. published a comprehensive joint report titled “Abuse of Citizenship and Residence by Investment Programmes,” which warned that these programs—though themselves legal—are vulnerable to criminal exploitation, including laundering “billions of dollars,” and called for stronger, risk-based controls throughout the application lifecycle and status maintenance.

Key F.A.T.F./O.E.C.D. recommendations include:

- Multi-layered due diligence by both private and public entities

- Enhanced verification of sources of funds and wealth

- Thorough criminal-background checks covering all countries of residence

- Checks against international sanctions lists and Interpol databases

- Comprehensive beneficial-owner disclosure

- Collective-denial policies preventing “jurisdiction shopping”

- Mandatory in-person or virtual interviews

- Regular independent audits of compliance processes

- Effective revocation and information-sharing mechanisms

European Union Actions

In March, 2025, the European Commission announced a directive requiring all member states to terminate citizenship-for-investment programs by 2026 and apply enhanced due diligence to investors holding residency rights.

In April, 2025, the E.U.’s visa-suspension mechanism was strengthened to add “operation of investor-citizenship programs” as new grounds for triggering visa suspension—an effective tool for suspending visa-free access with third countries operating golden-passport programs. The E.U. successfully deployed this mechanism in November, 2024, to permanently suspend Schengen visa-free privileges for Vanuatu—marking the first time any country in the world received such punitive measures from the E.U.

U.S. Pressure on Caribbean Programs

The U.S.-Caribbean Roundtable of February, 2023, fundamentally transformed the landscape when Treasury Department officials presented a “Six Principles for C.B.I.” framework. Caribbean leaders, recognizing limited leverage against potential U.S. financial sanctions, agreed to comprehensive reforms, including complete suspension of Russian and Belarusian applications effective March 31, 2023.

Regional Harmonization in the Caribbean

In September, 2025, five Eastern Caribbean states (Antigua and Barbuda, Dominica, Grenada, Saint Kitts and Nevis, and Saint Lucia) signed a landmark agreement establishing the region’s first unified citizenship-by-investment regulator—the Eastern Caribbean Citizenship by Investment Regulatory Authority (E.C.C.I.R.A.). The new body will oversee all C.B.I. operations, enforce compliance, and impose sanctions, with headquarters in Grenada and regional offices in all five member states.

The agreement maintains a minimum investment threshold of two hundred thousand dollars established in 2024, ensuring programs “remain credible while generating revenue.” E.C.C.I.R.A. will maintain regional registries of applicants, licensees, and developers, publishing annual compliance reports.

Key reforms include:

- Mandatory biometric-data collection from new and renewing applicants

- Collective-denial policies preventing “jurisdiction shopping”

- Mandatory interviews for all applicants

- Enhanced Financial Intelligence Unit checks

- Independent third-party audits

- Restricted nationalities (suspension of Russian and Belarusian application processing)

- Unified due-diligence standards across all five programs

Best Practices and Risk Management

Multi-Layered Due-Diligence Architecture

Effective programs employ multi-layered due-diligence processes encompassing both private-sector and public checks at various stages. Rather than relying on a single verification, initial screening by licensed agents is followed by deeper investigation by independent firms and, finally, by government security agencies.

Some C.B.I. programs have formal multi-tier verification processes, often described as “four-layer due diligence”: preliminary K.Y.C. by authorized agent, document verification by the government C.B.I. unit, commissioning of independent international due-diligence reports, and final checks through law-enforcement and intelligence channels before approval.

Enhanced Source-of-Funds/Wealth Verification

Financial institutions increasingly require detailed documentation of source of funds (S.O.F.) and source of wealth (S.O.W.), particularly for P.E.P.s and high-risk applicants.

Best practices include:

- Comprehensive bank statements covering extended periods

- Tax returns from multiple jurisdictions

- Audited financial statements for businesses

- Documentation of asset sales or inheritances

- Proof of employment income or business profits

- Independent verification of valuations

- Forensic examination of complex financial structures

Continuous Monitoring and Post-Approval Oversight

Citizenship is increasingly not a “set it and forget it” acquisition. Many jurisdictions now conduct periodic reviews of economic citizens and may require updated information years after approval. Maintaining proper tax compliance in both the new country and previous residences is essential to preserving citizenship status and preventing revocation.

Revocation and Enforcement Mechanisms

Cyprus provides a comprehensive model for citizenship-revocation procedures. Under Cypriot law, citizenship will be revoked if obtained through false or fraudulent declaration, if the person is convicted of a serious criminal offense involving at least a ten-year sentence, or for actions contrary to the public good, including terrorism, corruption, violation of international sanctions, or actions harmful to the country’s position.

As of September, 2025, Cyprus has revoked citizenship from three hundred and sixty individuals (a hundred and one investors and two hundred and fifty-nine family members) based on judicial-inquiry findings that fifty-three per cent of citizenships granted between 2007 and August, 2020, failed to meet legal requirements.

Outlook and Conclusions

The direction is clear: heightened A.M.L./K.Y.C. expectations for all C.B.I. participants, including agents and law firms, not just governments and banks. Programs that emerged as relatively simple economic transactions have evolved into sophisticated pathways managed by international financial standards and subject to multilateral oversight.

For countries offering these programs, the message from F.A.T.F. and other international bodies is unequivocal: citizenship may be offered as an investment opportunity, but only with safeguards protecting the integrity of global financial and security systems. The future belongs to programs that can balance economic benefits with robust compliance.

The pendulum appears to be swinging decisively toward greater regulation, transparency, and enforcement. Whether C.B.I. programs can adapt to these higher standards while remaining economically viable remains an open question—but the era of poorly regulated “golden passports” serving as large-scale money-laundering tools is decidedly ending.

Services of Kancelaria Prawna “Skarbiec” for C.B.I./R.B.I. Programs

Kancelaria Prawna “Skarbiec” offers comprehensive legal support for clients considering citizenship and residency by investment programs:

Program verification and selection—analysis of available C.B.I./R.B.I. programs against client objectives and assessment of feasibility of achieving planned outcomes

Legal due diligence—comprehensive verification of legal, tax, and regulatory requirements of individual programs

Compliance-risk assessment—analysis of risks related to A.M.L./C.F.T., international sanctions, and transparency requirements

Source-of-funds documentation—preparation of professional Source of Funds and Source of Wealth documentation meeting international standards

Investment structuring—design of investment structures compliant with program requirements and minimizing tax risks

Representation in proceedings—support in applications, communication with authorities, and problem resolution

Post-approval compliance—advice on maintaining status, tax-residence requirements, and continuous monitoring

Protection against revocation—representation in cases of threatened citizenship or residency revocation

Kancelaria Skarbiec will help verify and select solutions suited to investor needs, and determine whether planned objectives can be achieved through obtaining second citizenship, considering growing compliance requirements and international oversight of these programs.